Lithium-ion batteries play a critical role in advancing sustainability efforts. From eco-friendly mobility to clean energy, many sustainability initiatives rely on this technology. This has resulted in a surge in the demand for lithium-ion batteries. Electric vehicles and energy storage systems are the primary applications driving this demand. According to the World Economic Forum, there has been a 50-fold increase in the sale of EV cars between 2012 (200,000 units) and 2022 (over 10 million). (1)

Recovery and Recycling of Metals From Spent Lithium-Ion Batteries

Topics: Battery recycling

Global e-waste statistics (Top Picks)

- Annual e-waste generation: The world generated 53.6 Mt of e-waste in 2019. That’s an average of 7.3 kg per capita. The amount of e-waste generated is expected to grow at about 3.5% per year and will reach 74.7 Mt by 2030. (2)

- E-waste recycling rate: In 2019 only 17.4% of the e-waste was collected and recycled. At the moment, the recycling activities are not keeping pace with the global growth of e-waste. (2)

- Value of the e-waste: The value of raw materials in the e-waste generated in 2019 was roughly USD 57 billion with only USD 10 billion recovered in an environmentally accepted way. Based on the Global e-waste monitor, gold, silver and palladium alone represent about USD 13.5 billion in value. (2)

- E-waste compared to the total waste: The world generates about 2 billion tonnes of waste annually of which 53.6 Mt in 2019 was e-waste. This means that e-waste represents about 2.7% of the total waste produced globally. (2)

- E-waste is not the best waste for a landfill: Plastic in the e-waste can take up to 1 million years to decompose, while aluminum and other metals can take anywhere between 50 and 500 years to break down. Some components in the e-waste will pollute the environment rather than biodegrade. (3)

- Mobile phones are a significant source of e-waste: Based on the Environmental Protection Agency report from 2014, in the US alone about 152 million mobile phones are discarded every year. (14)

- E-waste manufacturing is very resource-hungry: It takes at least 240kg of fossil fuels, 22kg of chemicals, and 1.5 tonnes of water to manufacture a single computer and its screen according to a UN study. This is more than the weight of a car. (15)

- E-waste represents a significant opportunity for circular economies: In 2019 seven UN entities released a report stating that annual e-waste production is worth over USD 62 billion annually. With only about 17% of e-waste recycled today, precious metals represent a significant value currently locked in the accumulated millions of tonnes of electronic waste. (16)

Topics: e-waste

ESG and Beyond: Achieve sustainability with emew technology.

Minimize your environmental impact

As technology advances, demand for metals continues to increase, causing economic, social, and environmental challenges in the supply chain. Existing mines may move out of operation as ores are depleted, lower-grade ores make processing and waste management more challenging, and stricter socio-environmental regulations may delay or hinder new operations from opening. Recycling has been highlighted by the United Nations (UN) as a key strategy for the success of the UN’s Sustainable Development Goals (SDGs). Recycling, defined as the reprocessing and repurposing of wastes, is essential because it closes the material flow loops to achieve a circular economy. (1)

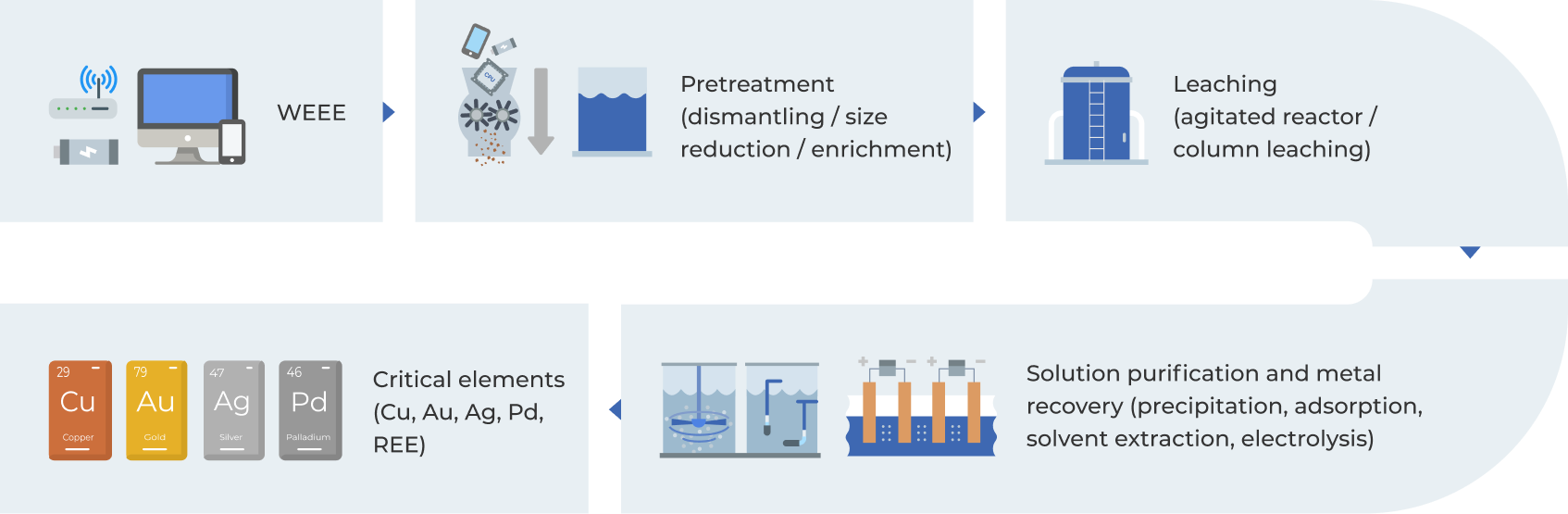

Recovery of precious metals and base metals from electronic waste

What if I told you that we send hundreds of millions of dollars to landfill every year? If you look around the room you are in right now, you will likely see a multitude of electronic devices. Our reliance on electronic devices in everyday life is growing and rapid technological advances continuously bring updated models onto the market. This means that more devices are being discarded, with more being sent to landfill than ever.

Several base and precious metals make up essential components of electronic devices. The properties of these metals make them ideal for recycling and reuse. Yet, studies have shown that only 15-20% of electronic devices are recycled. This leaves a huge untapped volume of valuable metals that could be sold or reused instead of sitting in landfills. Effectively recovering metals from these devices could have multiple ecological benefits from reducing the economic burden of electronics recycling to reducing the demand for mining ore.

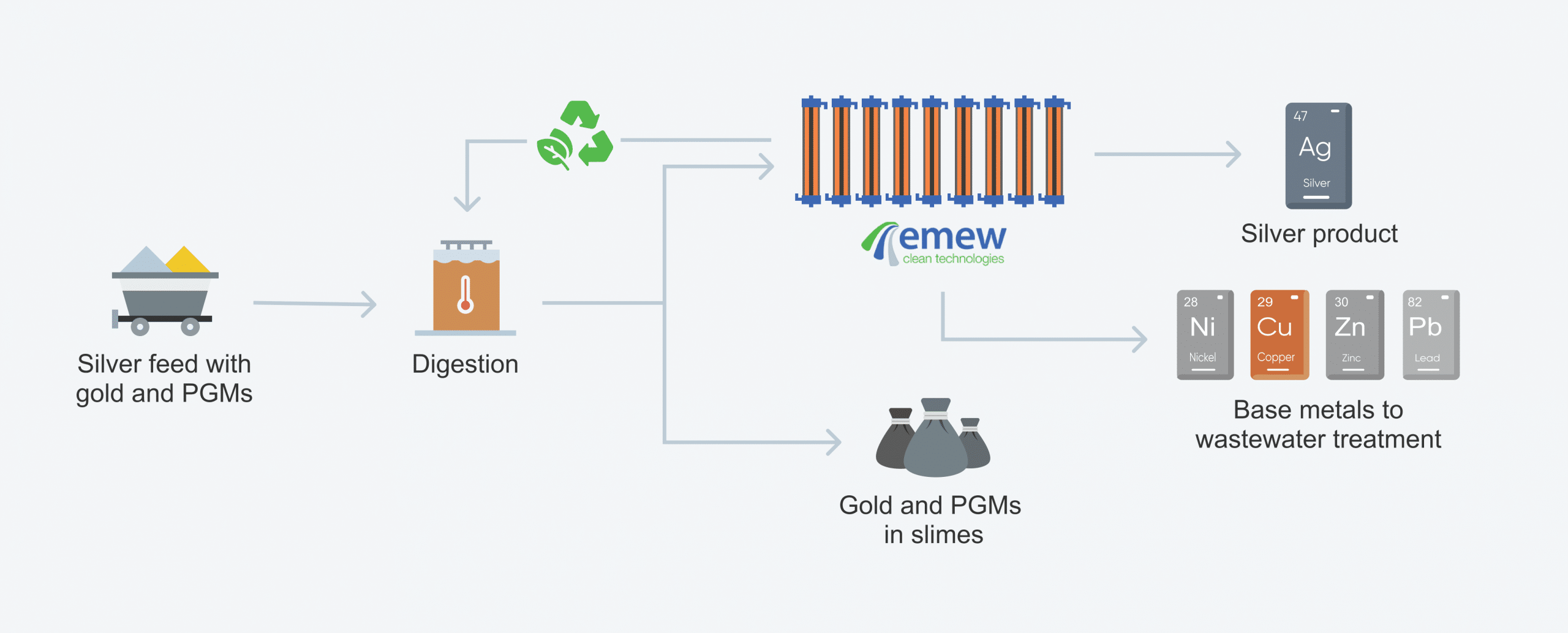

What is silver refining?

Silver refining is typically the final process in the production of high-purity silver suitable for sale in the market. It is associated with purity and typically needs to meet a minimum of 99.9% purity and in most cases 99.99% purity and in some cases, 99.999% purity depending on the end-use.

Electrowinning – an introduction

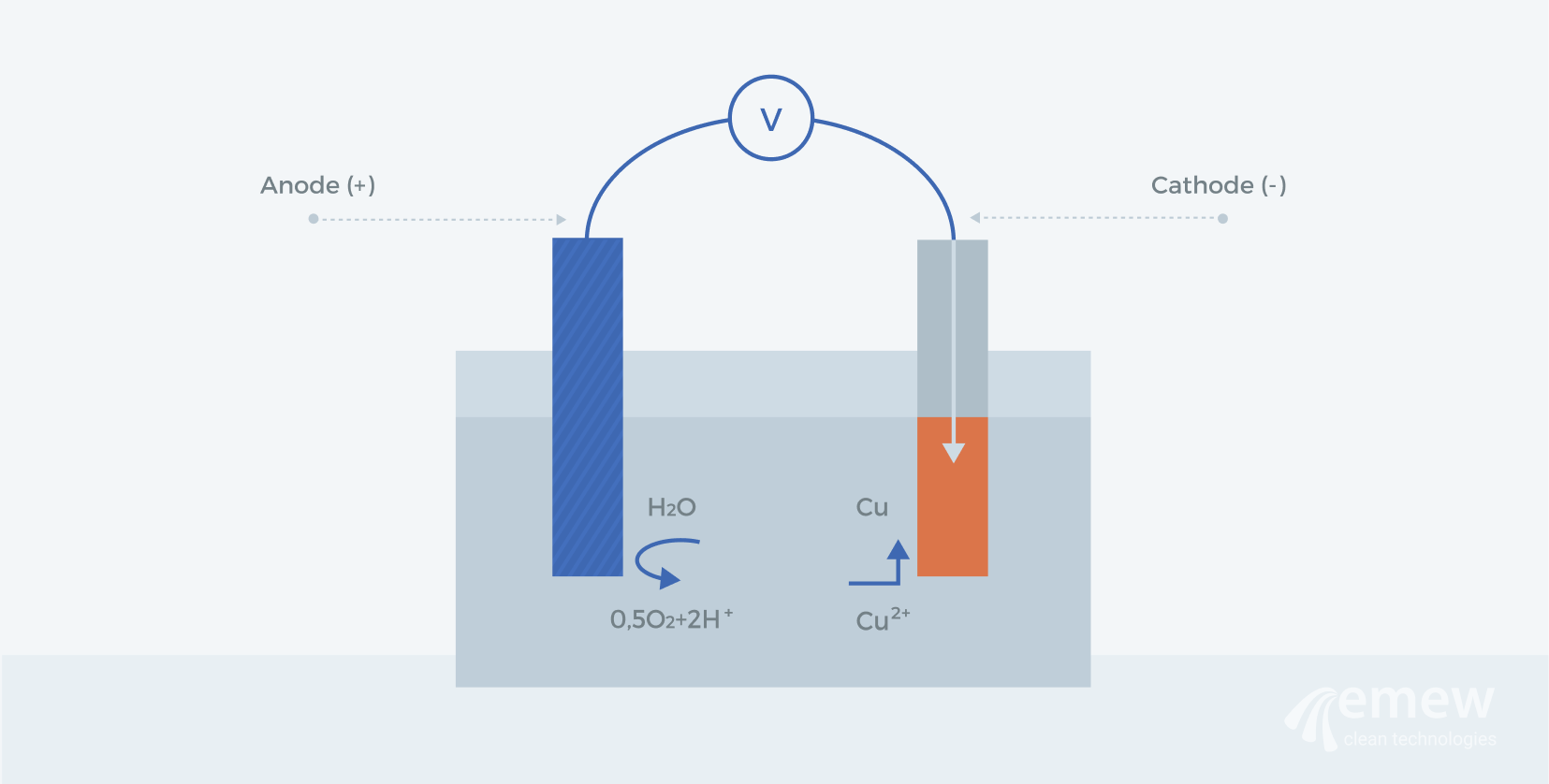

Electrowinning is a process used to recover metals from a solution or an electrolyte, by means of an electrolytic chemical reaction. This occurs when an electric current passes from a cathode that's negatively charged to a positively charged anode through a metal-containing solution. During this process, the electrons reduce the metal ions in the solution to form a solid metal deposition on the cathode. The quality of the metal produced can vary depending on the individual process and may require further processing or refining.

Nickel powders are widely used in industrial applications worldwide, such as rechargeable batteries, manufacturing and powder metallurgy. In some cases, nickel powders are used to add a magnetic feature to a particular material. Nickel can be used in electroplating and coinage industries as well. But there is more to nickel powder, and there is something that you have probably never heard about until now.

Topics: metal finishing, Advanced Metal Powders

Metal Finishing: What's Electrowinning got to do with it?

What is Metal Finishing?

Metal finishing is a type of surface finishing that can be defined as the deposition of a metallic coating onto a product either to enhance performance, function or aesthetic qualities while providing overall added value. While it's not obvious on a daily basis, many objects have been subjected to metal finishing for use in our normal lives. These include parts in a car, aircraft, fencing, medical and dental devices, industrial machinery or even beautiful pieces of art. The term finishing is based on the fact that it's normally the last step of the manufacturing process (save for any heat treatment).

Topics: Wastewater Treatment

When will Artificial Intelligence take over your factory?

While Elon Musk compares AI to “summoning the demon” and Bill Gates doesn’t “understand why some people are not concerned” that artificial intelligence slowly but steadily becomes a part of our daily lives.

Our mobile phones are equipped with Siri, Cortana or Google Now that assist us with daily tasks. Self-driven cars are already on our roads, driving thousands of miles with ZERO accidents (or at least they are not the reason for the accidents).

Retailers like Amazon and Target use a self-educating software that can anticipate your needs and offer you the next product to buy even before you know you need it.

How about these online customer support chats? Did you know that most of them are machines hiding behind human names? Many of them have the ability to learn and to adapt to the tone of questions in order to search company websites and present the right information to the customer.

Topics: General

Copper Recovery from an Acid Mine Drainage Stream

Acid mine drainage: we’ve all heard of it, and its negative reputation. But what if we told you that it’s not all bad? What if this environmental pollutant was recovered and transformed into a profit-turning resource? [Bejan & Bunce, 2015] There are varying methods of dealing with acid mine drainage (AMD), but only some of them are economically viable and effective long-term. This blog post is going to dive into some of the solutions for the treatment of AMD, and how emew technology provides one of the most promising alternatives, specifically for copper recovery from acid mine drainage.